Why do risk assessment?

The chance of a loss on an asset, loan, or investment is evaluated using a process known as „risk assessment,“ which is utilized broadly across various sectors. The value of an investment and the appropriate process(es) to manage risk can only be determined after conducting a thorough risk assessment. It shows the potential gain, in light of the potential loss. In order to decide whether an investment is worth the risk it poses, it is necessary to do a thorough risk analysis.

Using risk assessment in an investment strategy

Expected levels of risk are present in both institutional and personal investments. This is especially true of assets that aren’t guaranteed, including stocks, bonds, mutual funds, and ETFs.

The volatility of an investment may be estimated using standard deviation, which is calculated by dividing the rate of return by the standard deviation of the rate of return. High volatility is typically associated with higher risk. It is common practise for investors to check the standard deviation of each stock they are considering purchasing before making a final purchase.

The historical volatility (or lack thereof) of a stock is rarely a reliable indicator of its future performance. Even investments with a history of low volatility may now be subject to large swings in the event of a sudden shift in market circumstances.

Managing risk

Investing risk is inevitable and cannot be avoided. However, asset allocation and diversification are two fundamental investing methods that can aid in the management of both systemic risk (risk affecting the whole economy) and non-systemic risk (risk impacting only a portion of the economy or even a single firm).

Diversify with Baierkraft

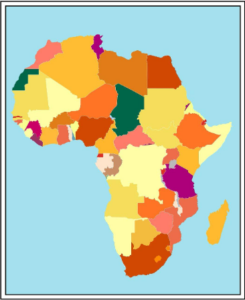

If you are looking for a way to diversify your investments and back a growing company with a proven track record, then consider investing in Baierkraft today as we make headway in emerging markets.

Find investment opportunities with an established motorcycle manufacturer. Contact Baierkraft today.